Technical Education & Innovation Center

Donate to the Technical Education and Innovation Center Today

CCCC intends to build a Technical Education and Innovation Center to house our premier academic programs Renewable Energy, Nursing and Allied Health, and Agriculture. The Center will provide state-of-the-art access to quality education in fields of critical-need and high-demand in rural Kansas. This project supports the economic response and recovery from the COVID-19 pandemic by providing access to quality education for high demand jobs in Kansas. CCCC’s Technical Education and Innovation Center (hereinafter referred to as the “Center”) is in direct response to the educational and workforce needs outlined in the Kansas Chamber’s report, The Challenge to Compete – Kansas Workforce 2020. The Center will also have an immense impact on Kansas rural communities through all three academic programs.

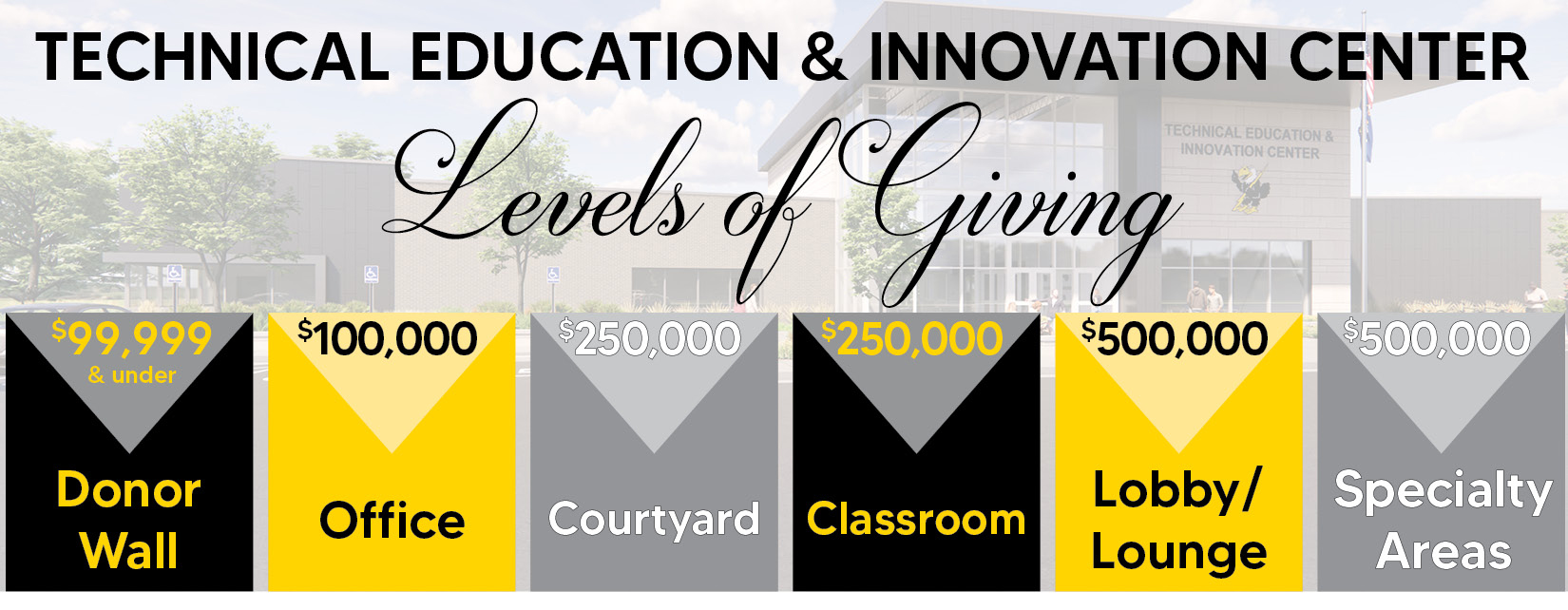

CCCC is in the late stages of fundraising for the Center by engaging industry partners for naming opportunities and applying for additional grants. CCCC has built strong relationships with industry and legislative partners in the pursuit of this project. This pursuit began with the sound partnership between CCCC and its Foundation, as they committed $1,500,000 to demonstrate their dedication to the mission and purpose of this project. With this lead gift, CCCC was able to leverage industry partners for additional support. Salina Regional Health Center and their affiliates are a major partner with CCCC’s Nursing and Allied Health programs relying on our graduates to fill positions within their facilities. Because they are invested in the vitality of our local community and our missions align, Salina Regional Health Center donated $1,000,000 to the Center.

Another significant partner to this project has been the Kansas legislature. CCCC submitted this project to the Kansas legislature for Federal American Rescue Plan Act Appropriations in March of 2022. The legislature responded by supporting the project with a direct appropriation of $4,000,000 to CCCC in the Higher Education budget. The most recent major partner in this project has been the Sunderland Foundation with a grant award of $1,000,000.

We want you to be a part of this historic moment! Donate to the CCCC Technical Education and Innovation Center today and help us build tomorrow's workforce. DONATE TODAY!

Participate in the Kansas Community College Capital Improvement Tax Credit

Who

Kansas Income Taxpayers, Kansas Premium Taxpayers, and Kansas Privilege Taxpayers.

When

Effective on and after July 1, 2022 and prior to December 31, 2025.

Purpose

A tax credit shall be allowed for any taxpayer that contributes to a community college located in Kansas for capital improvements, deferred maintenance, or the purchase of technology and equipment.

Tax Credit Amount

The credit is 60 percent of the total amount contributed during the taxable year by the taxpayer to a community college located in Kansas.

Tax Credit Limitation

In no event shall the total amount of credits allowed for taxpayers who contribute to any one such community college exceed $250,000 in any one tax year. Community colleges are also capped at awarding a maximum of $500,000 in total from their college. A statewide cap on the number of credits that are available to be awarded is $5,000,000. If the amount of credit exceeds the taxpayer’s tax liability, the remaining credit is not allowed to carryover or to be refunded. Kansas Community Colleges have determined to be eligible for this credit, that the minimum donation for which a credit will be offered will be $1,000.

How to Claim the Tax Credit

Qualified taxpayers who have contributed to a community college on or after July 1, 2022, will be required to file the appropriate tax return electronically and follow the proper steps in preparation of their tax return to claim the credit as directed on the Kansas Department of Revenue website.

Click the Tax Credit Form below to take advantage of this opportunity!

Non-Discrimination | A-Z Index

Taxpayer and Student Transparency Data

Copyright 2019, Cloud County Community College

Locations

Concordia Campus

2221 Campus Drive

Concordia, KS 66901

Geary County Campus

631 Caroline Ave.

Junction City, KS 66441

800-729-5101

Cloud County

Cloud County